Sri Lankan microfinance institutions face increasing operational and regulatory pressure due to outdated and fragmented software systems. Many organisations continue to rely on legacy applications, spreadsheets, and disconnected databases that limit efficiency, transparency, and scalability.

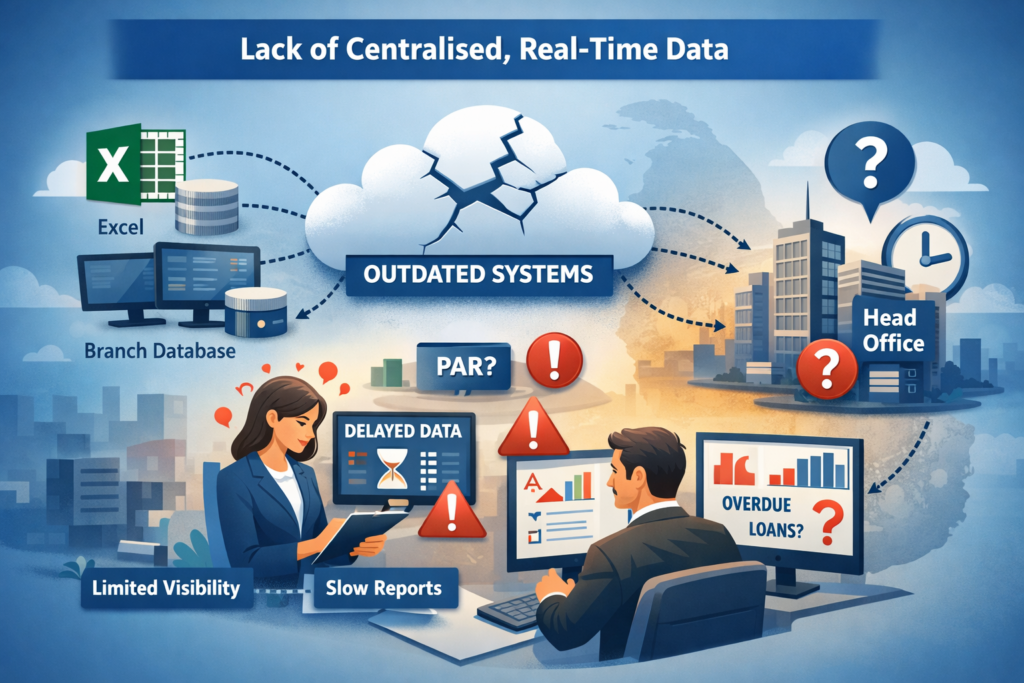

A major challenge is the lack of centralised, real-time data. Without a unified microfinance core system, institutions struggle to monitor loan portfolios, collections, borrower exposure, and non-performing loans accurately. Delayed or manual data updates prevent timely risk identification and decision-making.

Another critical issue is weak risk and compliance controls. Many systems do not support borrower exposure analysis, early warning indicators, or automated regulatory reporting. This increases the likelihood of over-indebtedness, compliance gaps, and audit challenges.

Existing microfinance software platforms often provide incomplete loan lifecycle management, making it difficult to handle flexible loan products, restructurings, rescheduling, and write-offs. These limitations increase manual work and operational risk.

Limited support for field operations and digital collections further impacts performance. The absence of mobile-enabled tools, payment integrations, and borrower communication channels results in cash-heavy operations, higher costs, and reduced customer trust.

To address these challenges, Sri Lanka’s microfinance sector requires modern, secure, cloud-based microfinance software that delivers real-time visibility, strong governance, digital integration, and scalable growth.

At Zentrixs, we enable microfinance institutions to move beyond legacy systems with intelligent, compliant, and future-ready technology platforms designed for sustainable financial inclusion.